Contact

Links

Descriptions

Short

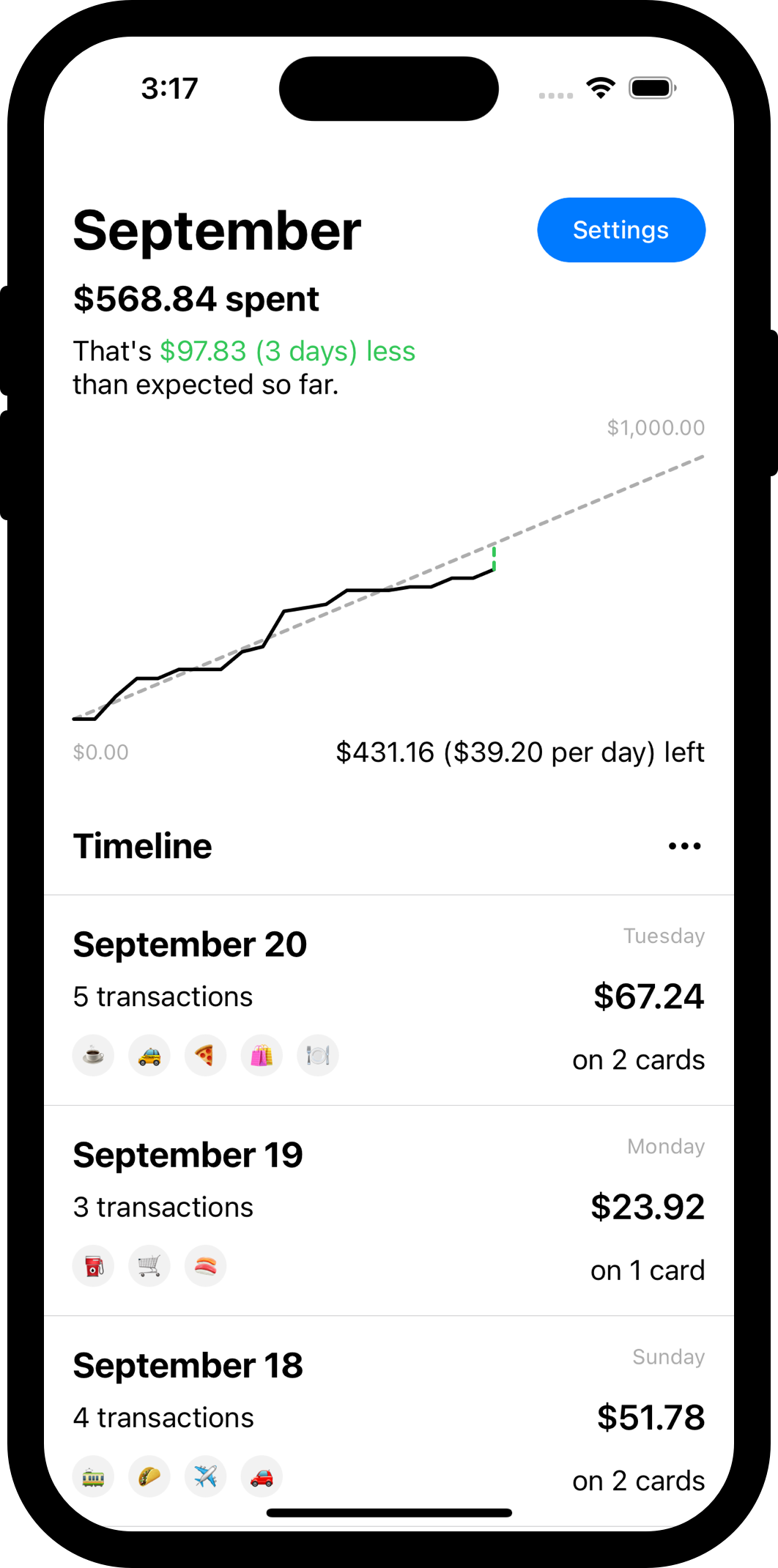

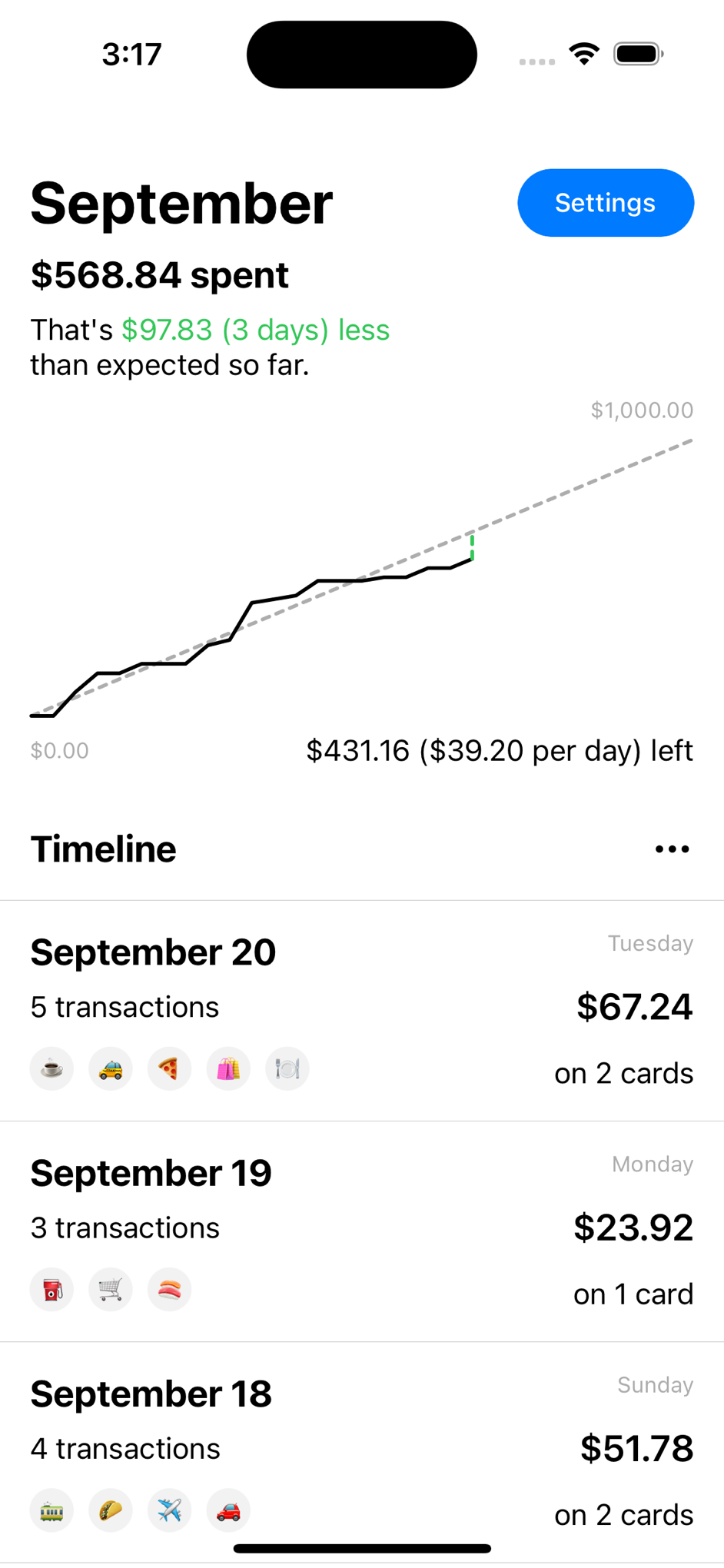

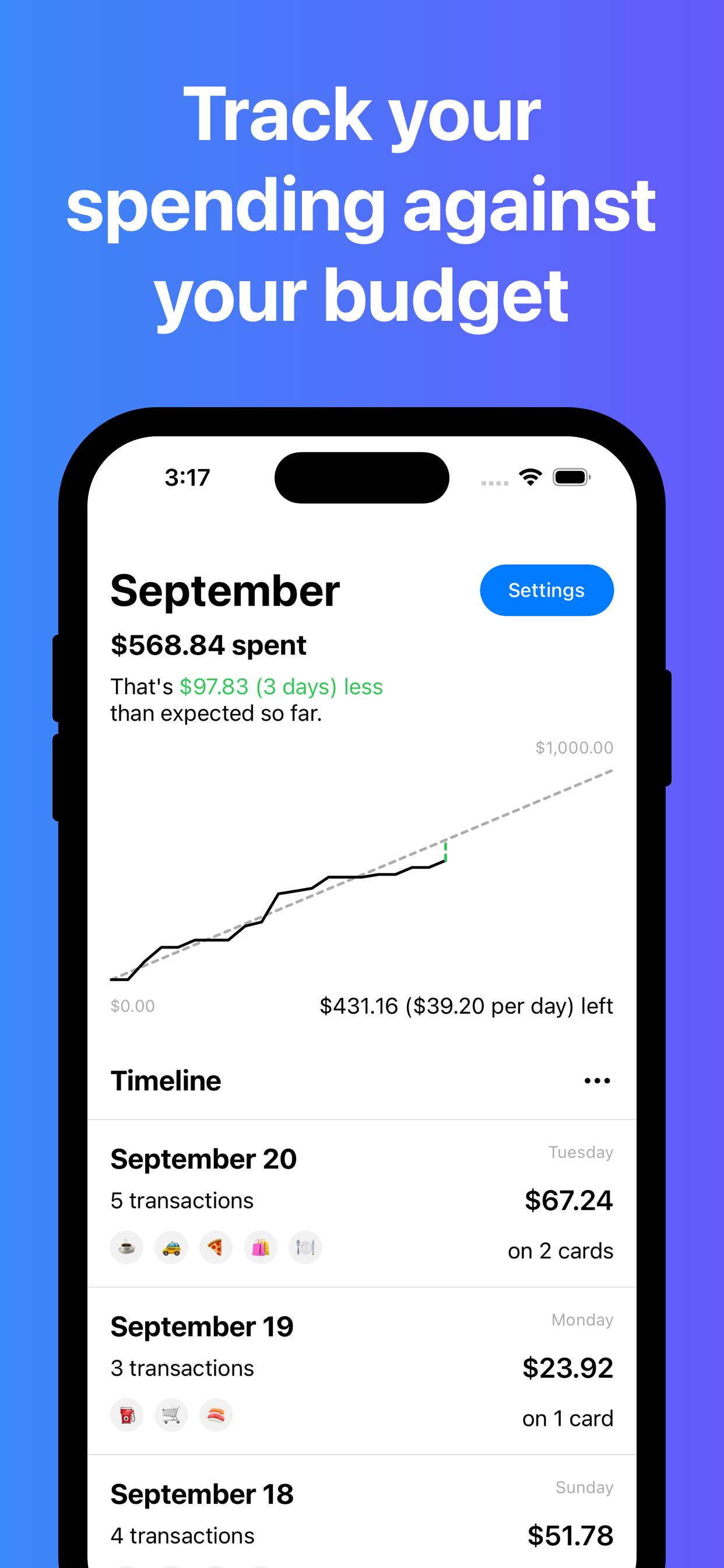

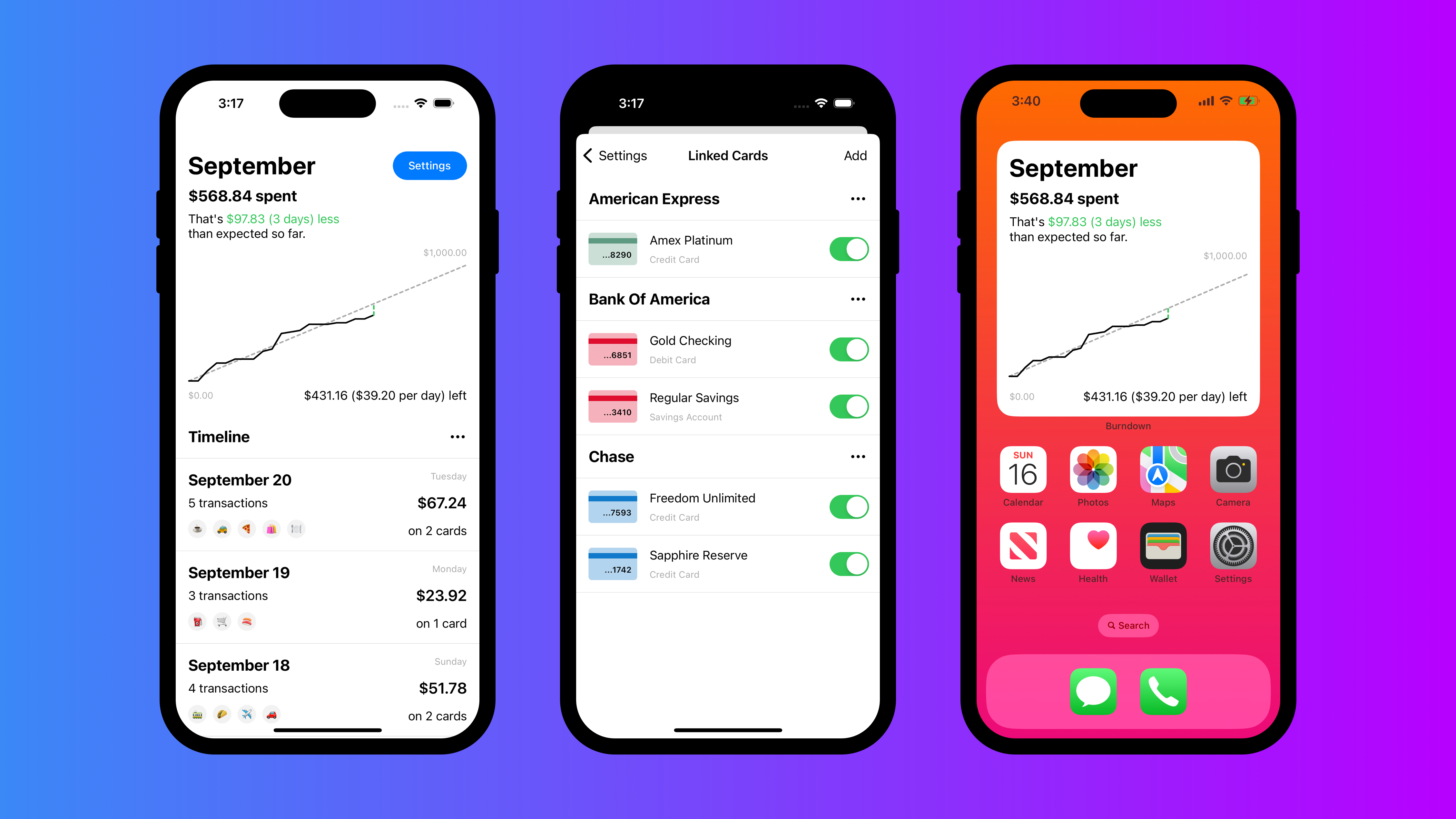

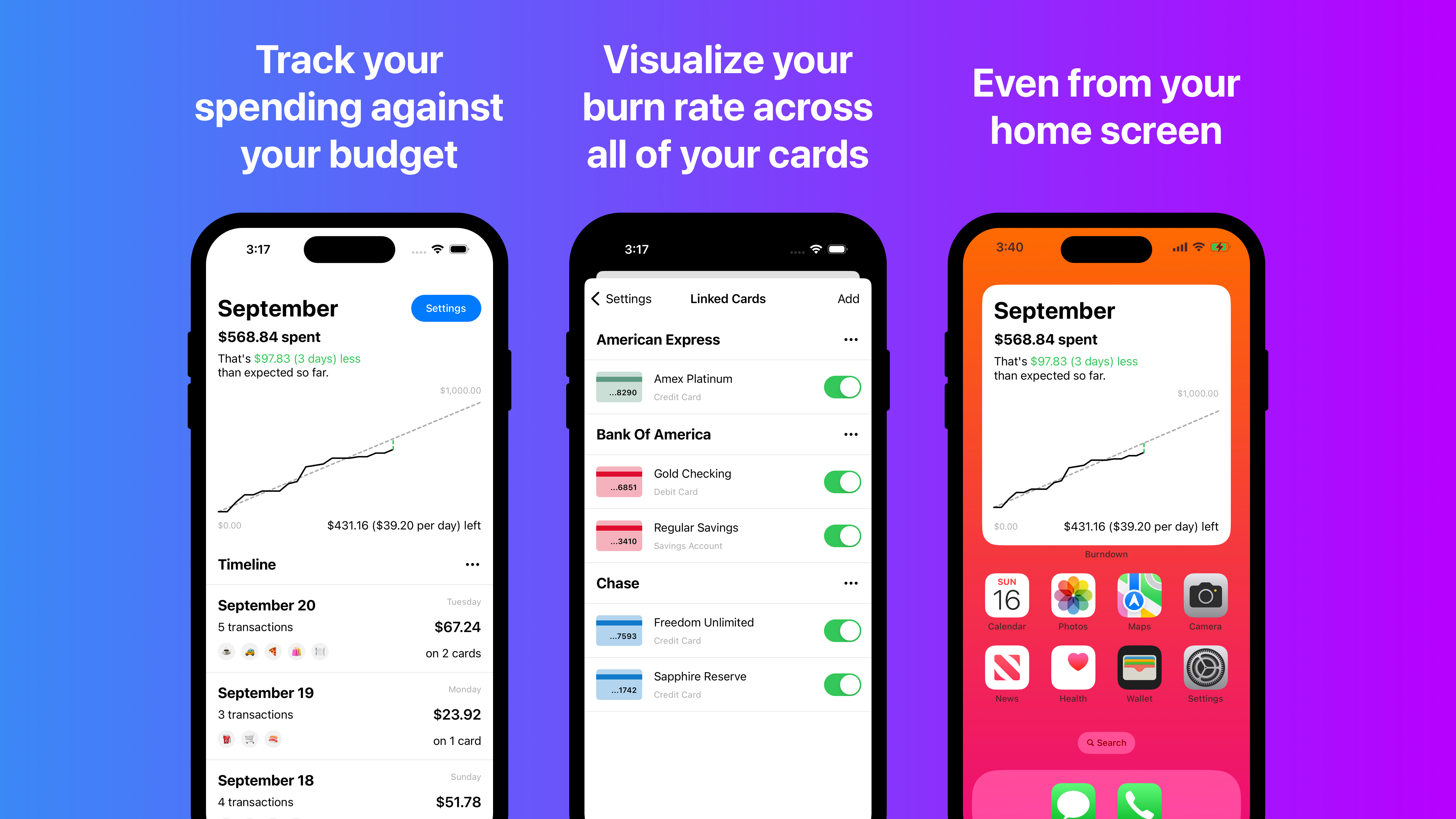

Visually track your spending against your budget across all of your cards.

Long

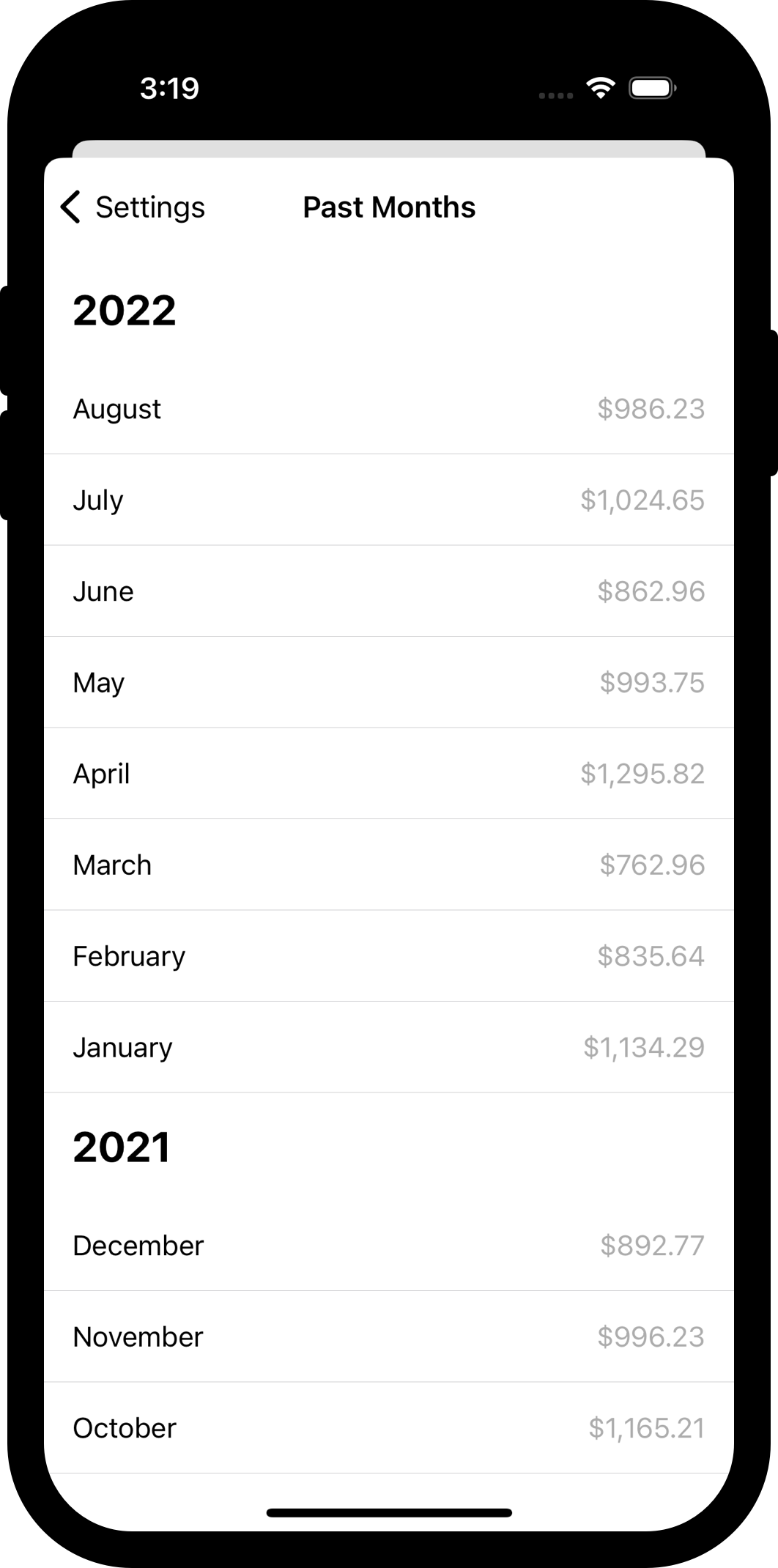

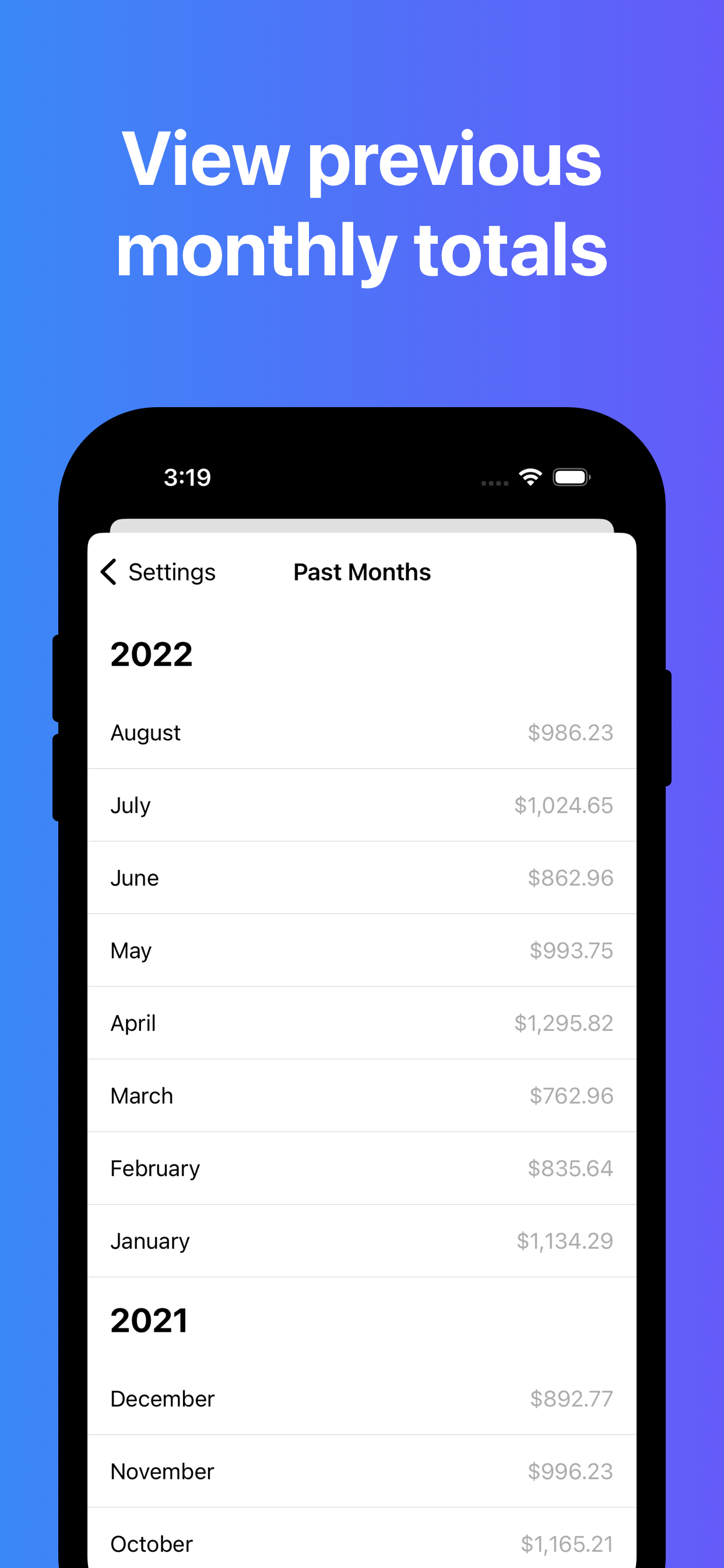

Budget Burndown is a simple personal finance app for tracking your monthly burn rate. Visually track your expected vs. actual spending rate across multiple cards on a single chart. If you keep the lines matched up, you're staying on budget. It's a quick and intuitive way to track your spending without all of the bloat that makes other budgeting apps so frustrating to use.

Walkthrough

Setup

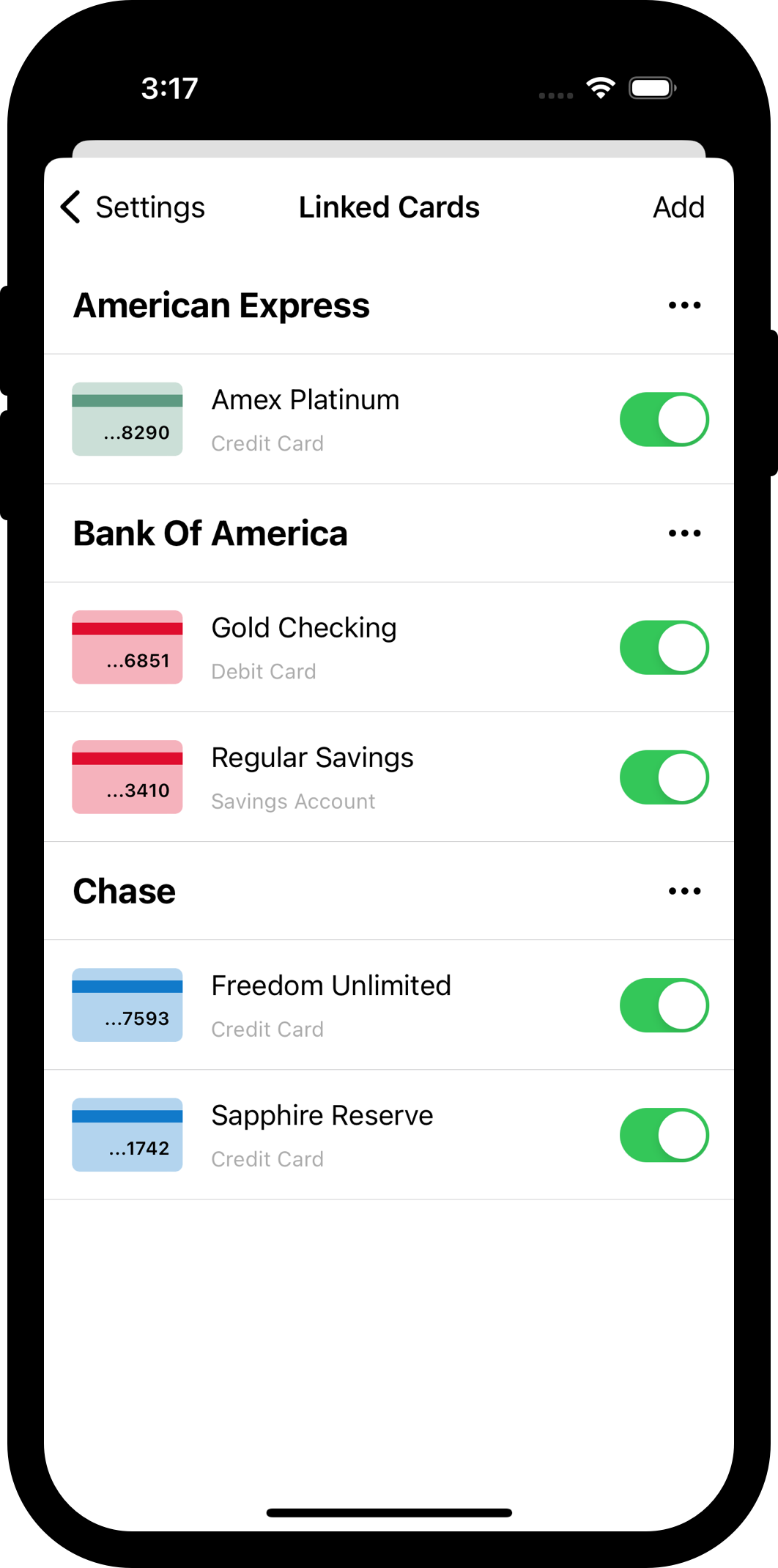

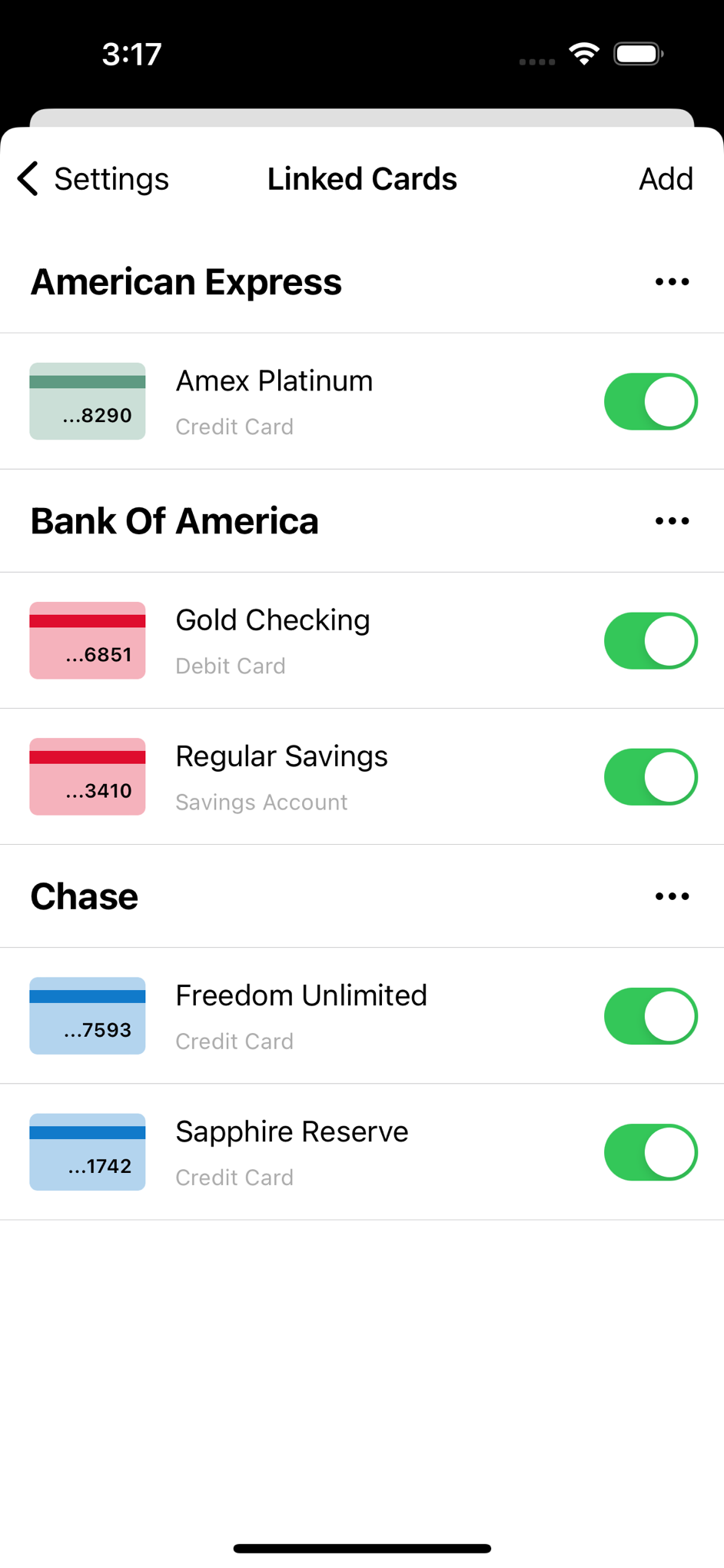

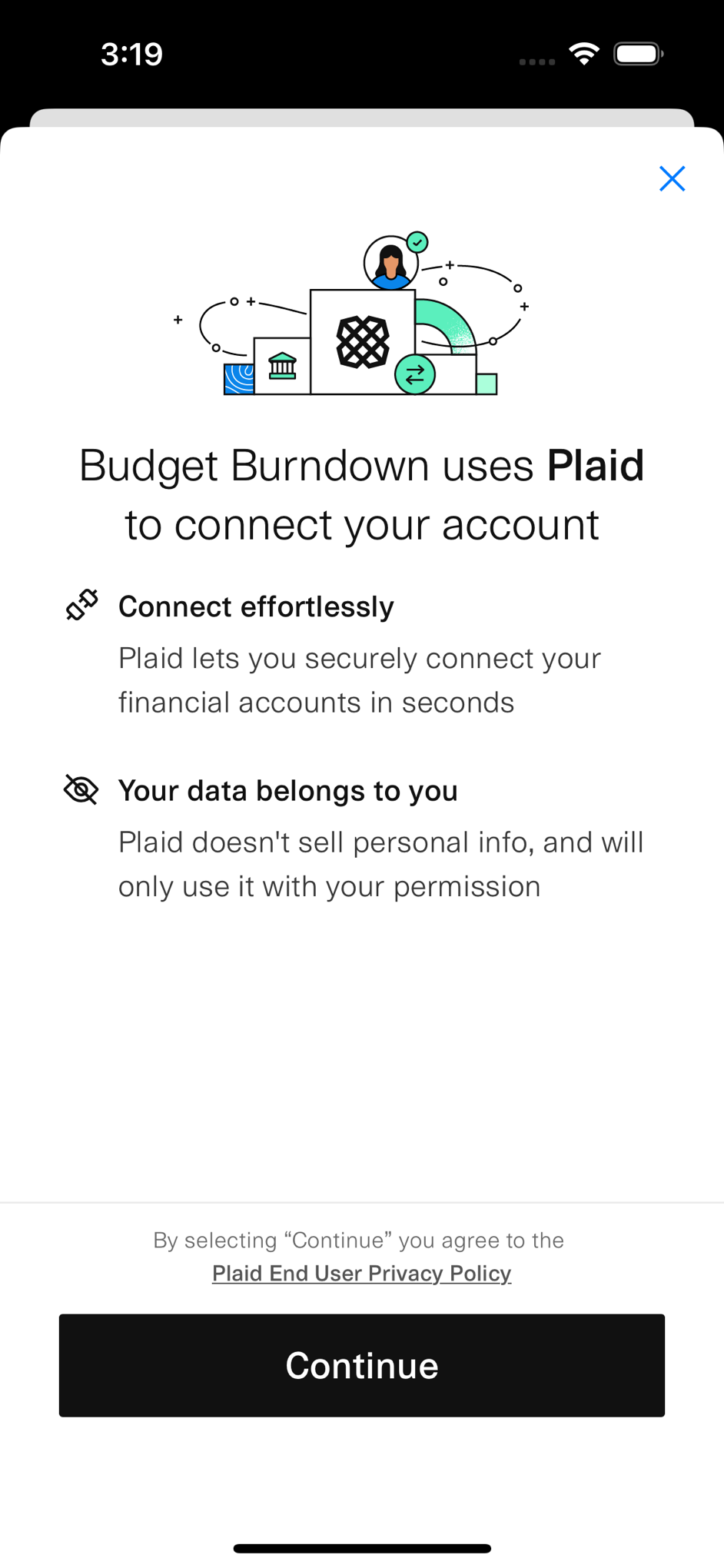

Link your cards

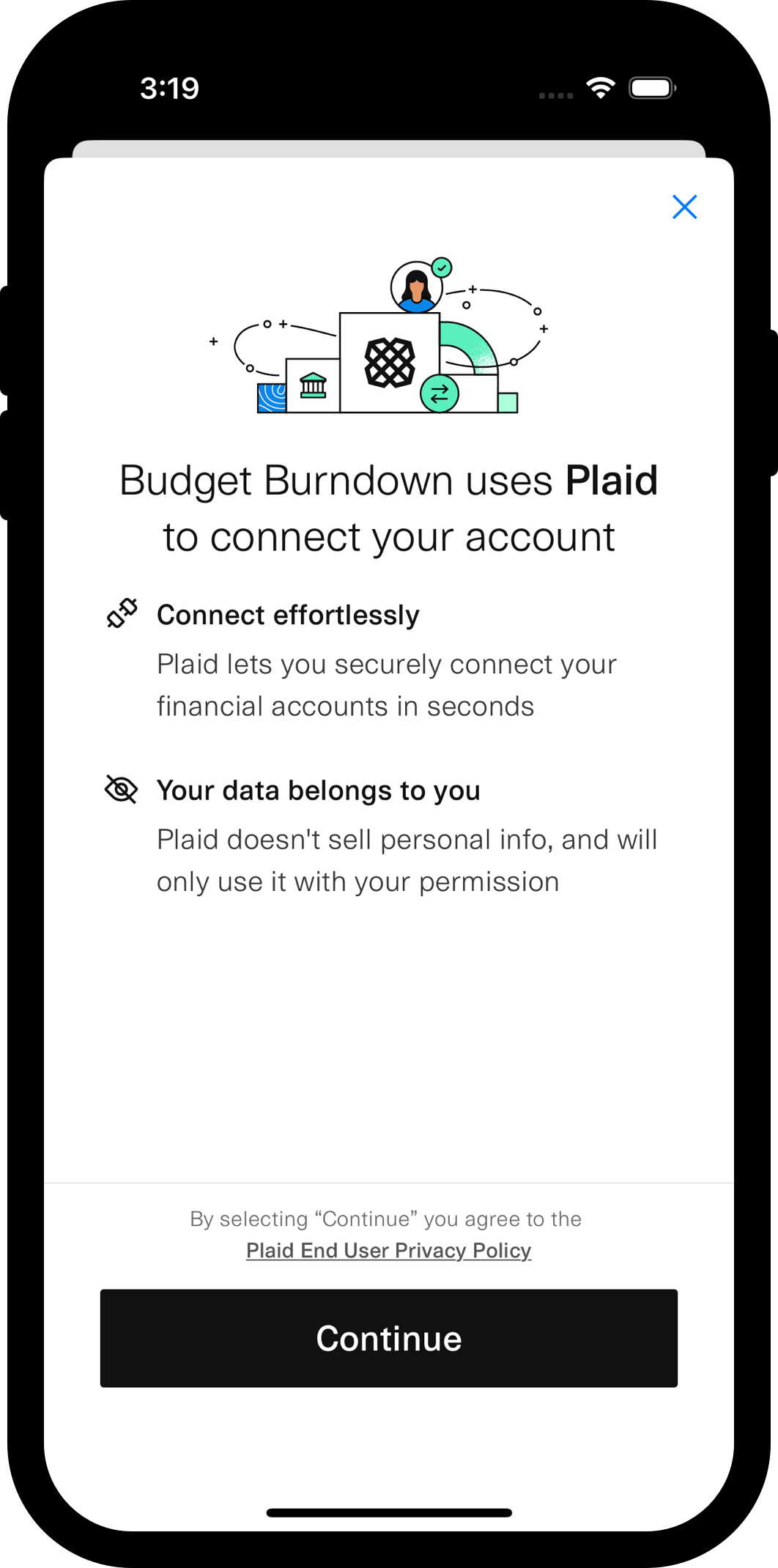

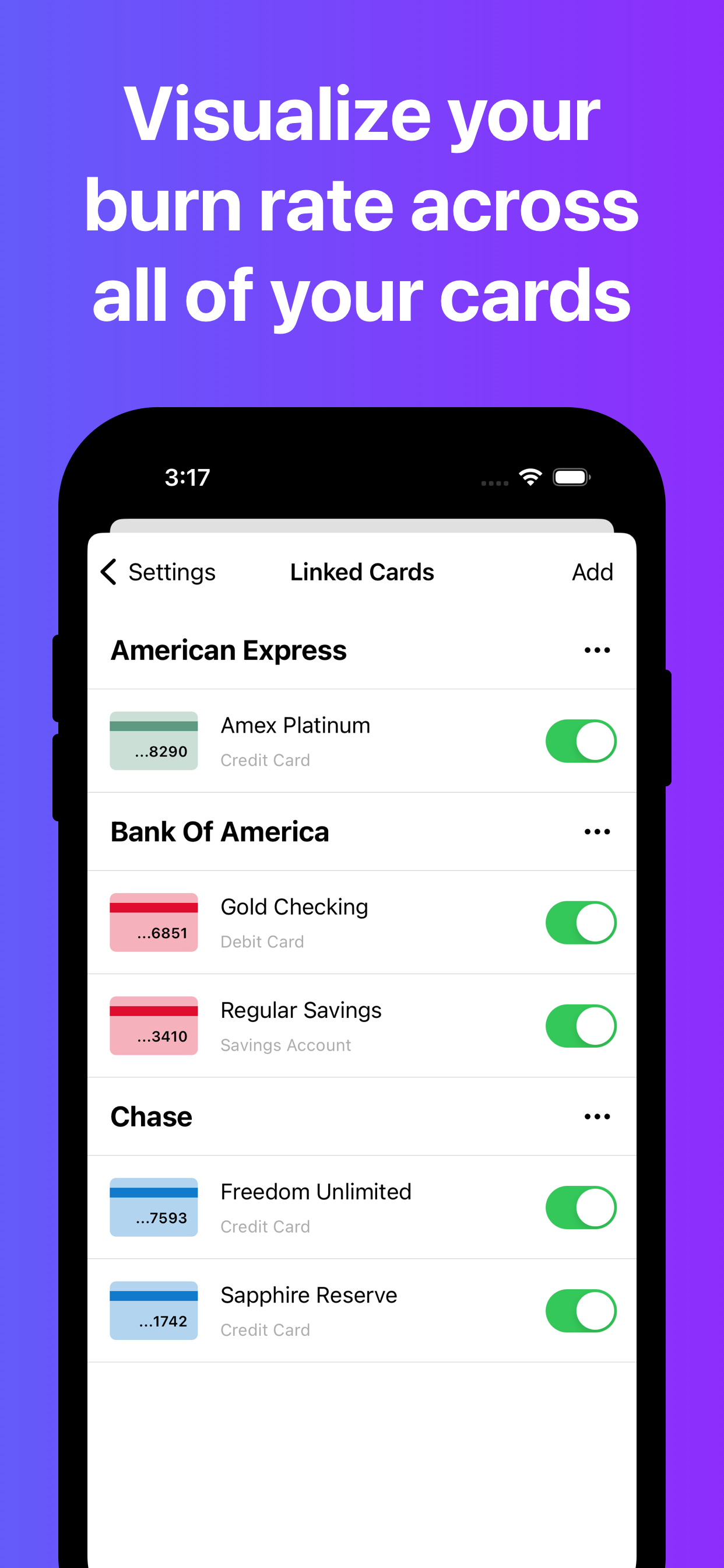

When you open the app for the first time, you'll be asked to sign in and link your first card. We recommend that this is the card you use for most of your day-to-day spending. You can link more cards from the Settings menu at any time.

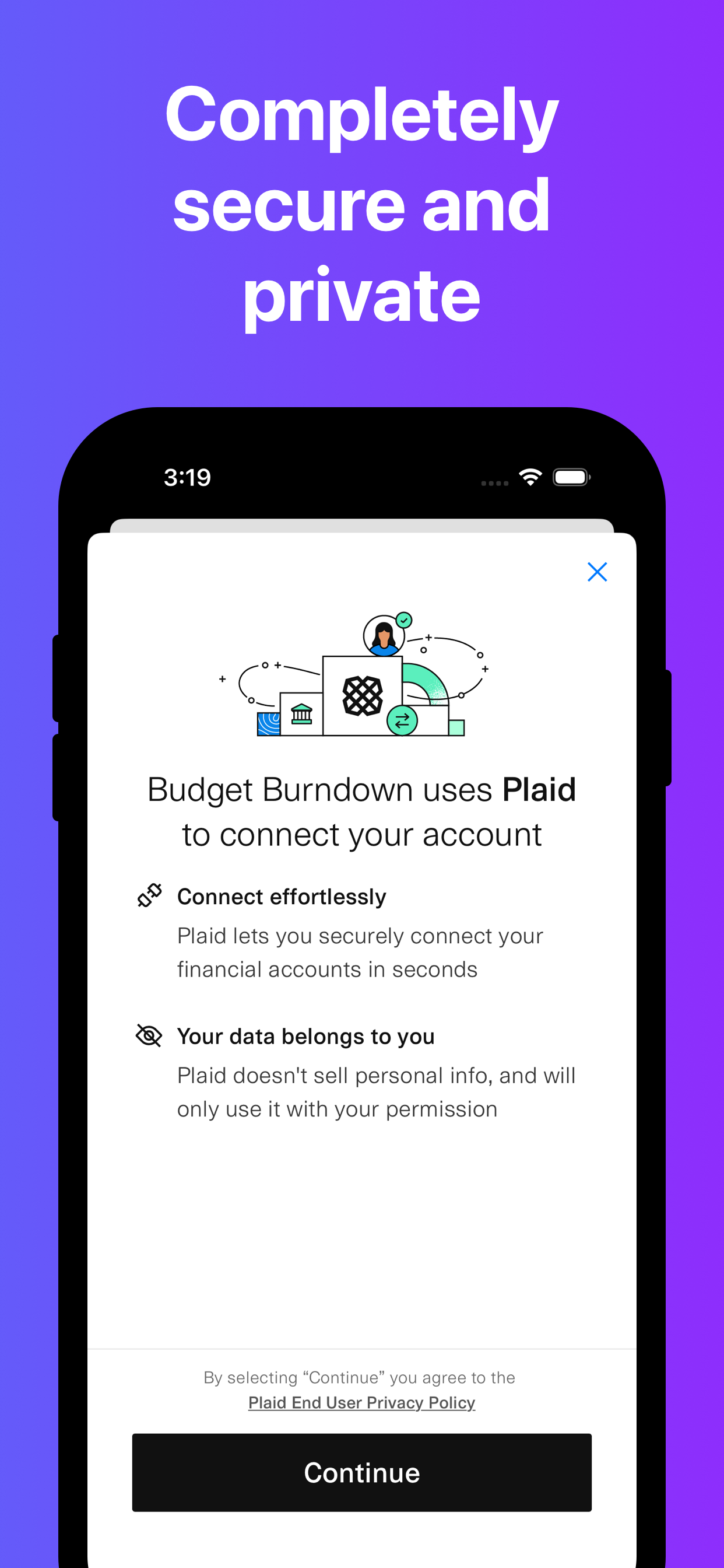

You'll use Plaid to link your cards. Credentials are end-to-end encrypted and completely inaccessible to the app.

If you're in a region in which linking cards with Plaid isn't supported, you'll be able to add transactions manually.

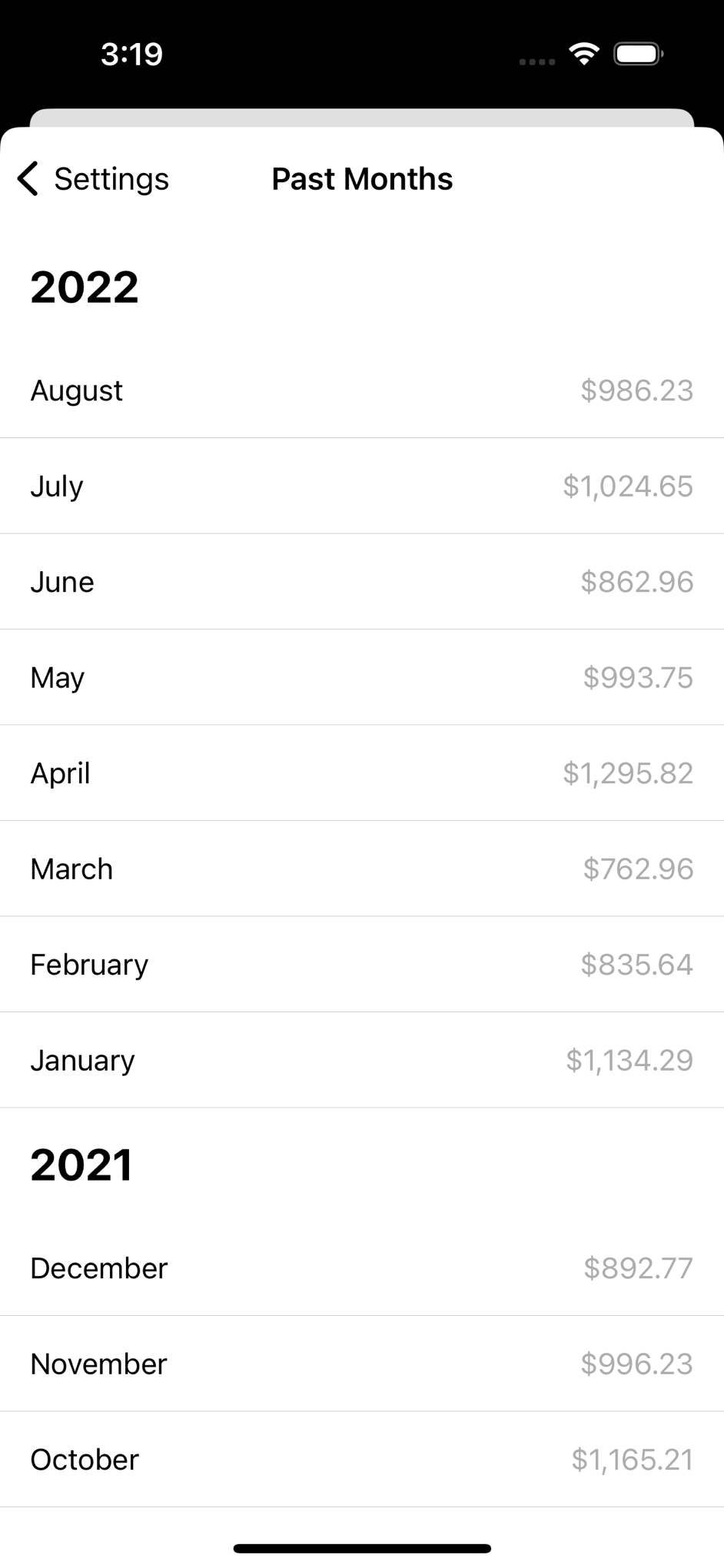

Set your monthly budget

Next, you'll be asked to set a monthly budget. We suggest initially setting this to how much you usually spend on your linked card every month (if it's a credit card, this would be your average statement balance). You can always change this from the Settings menu.

Usage

With cards linked and your monthly budget set, your burndown will populate for the current month, and will stay up to date automatically as time goes on.

If your spending line is above the budget line, it means that you've spent more than you should have so far. If it's below, then you've spent less than you could have so far. You know you're staying on track if you're keeping the two lines matched up throughout the month.

App Details

Feature List

-

A Visual Spending Tracker

Automatically track your spending against your monthly budget across multiple accounts. Add transactions manually when linking cards is not supported in the region.

-

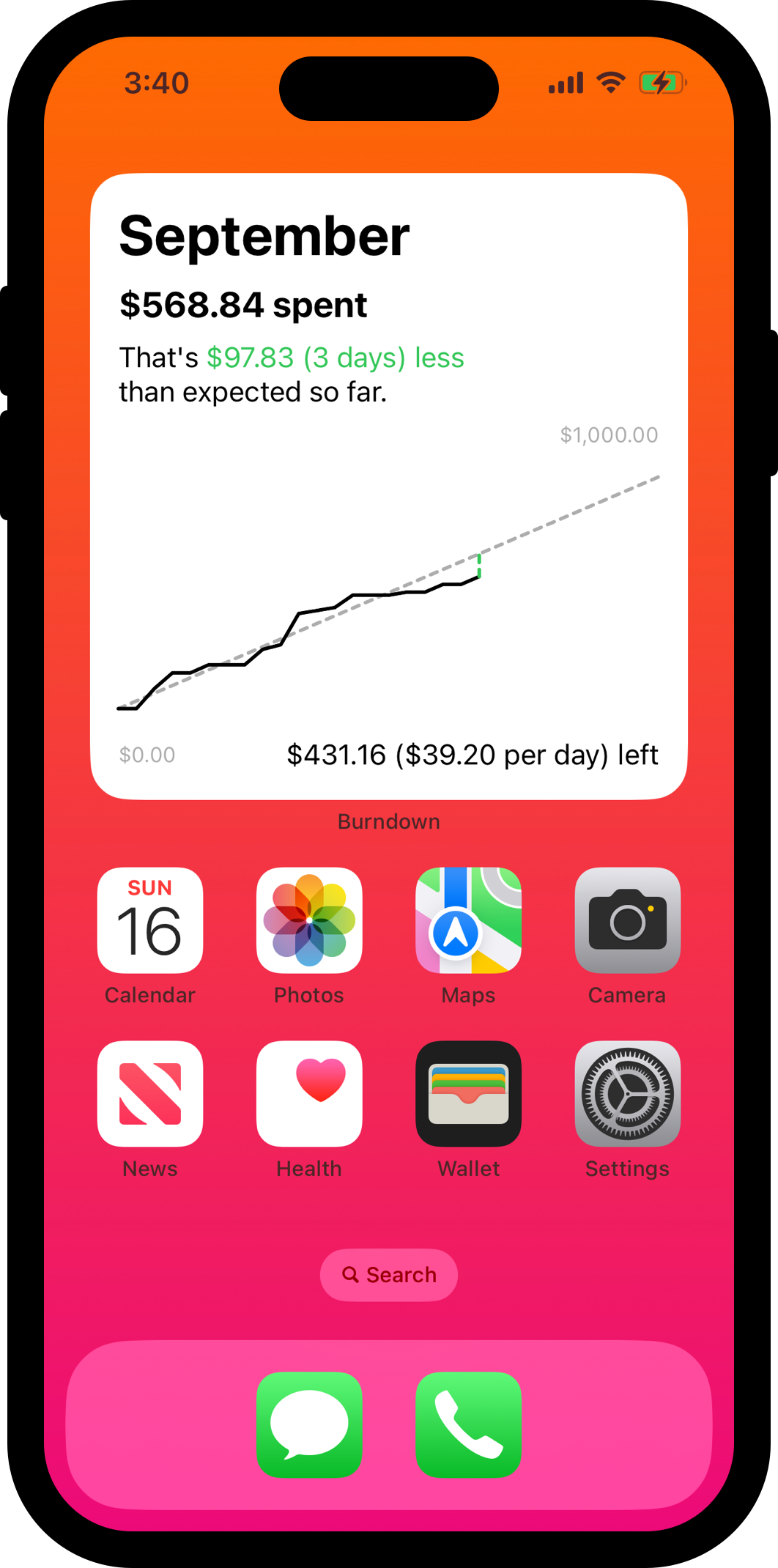

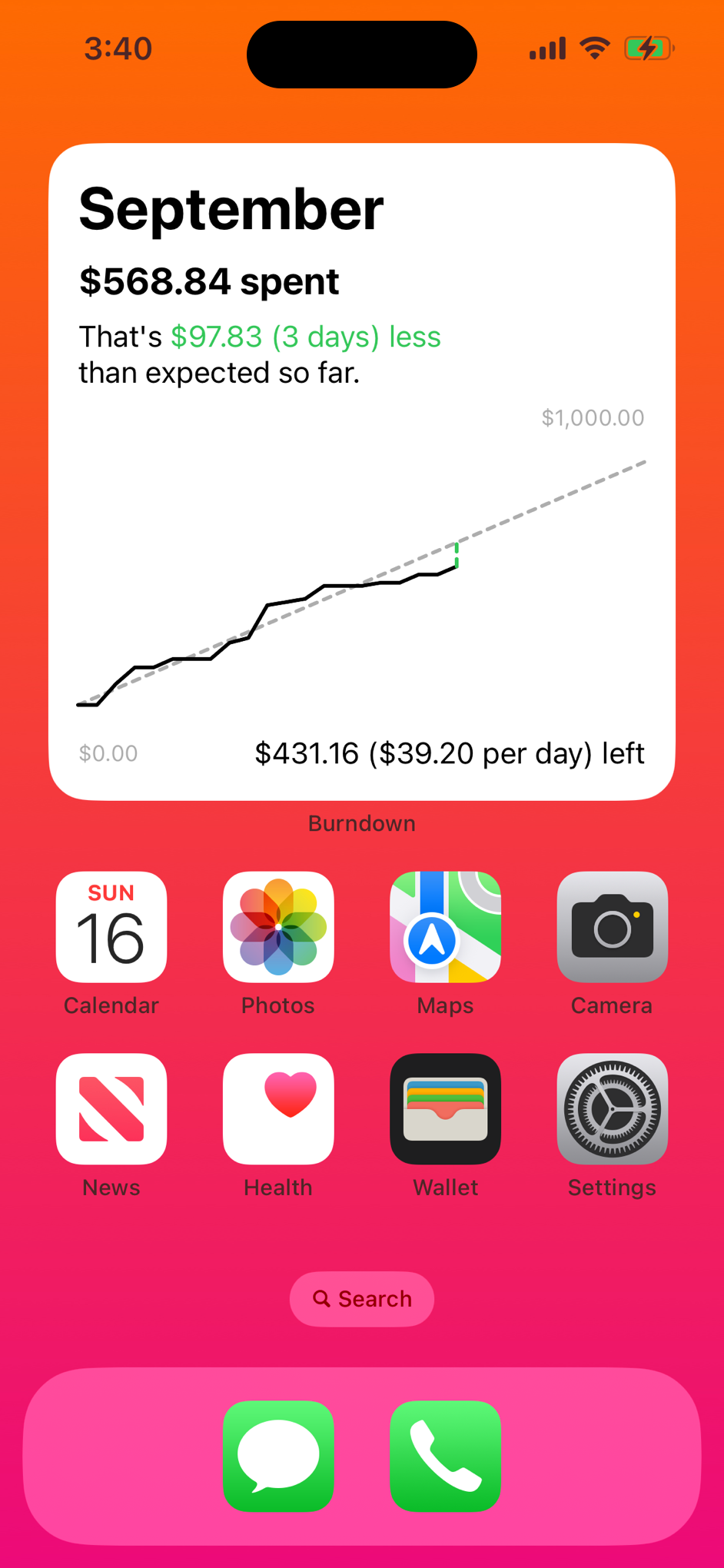

Home Screen Widgets

At-a-glance visibility into your burn rate without even opening the app.

-

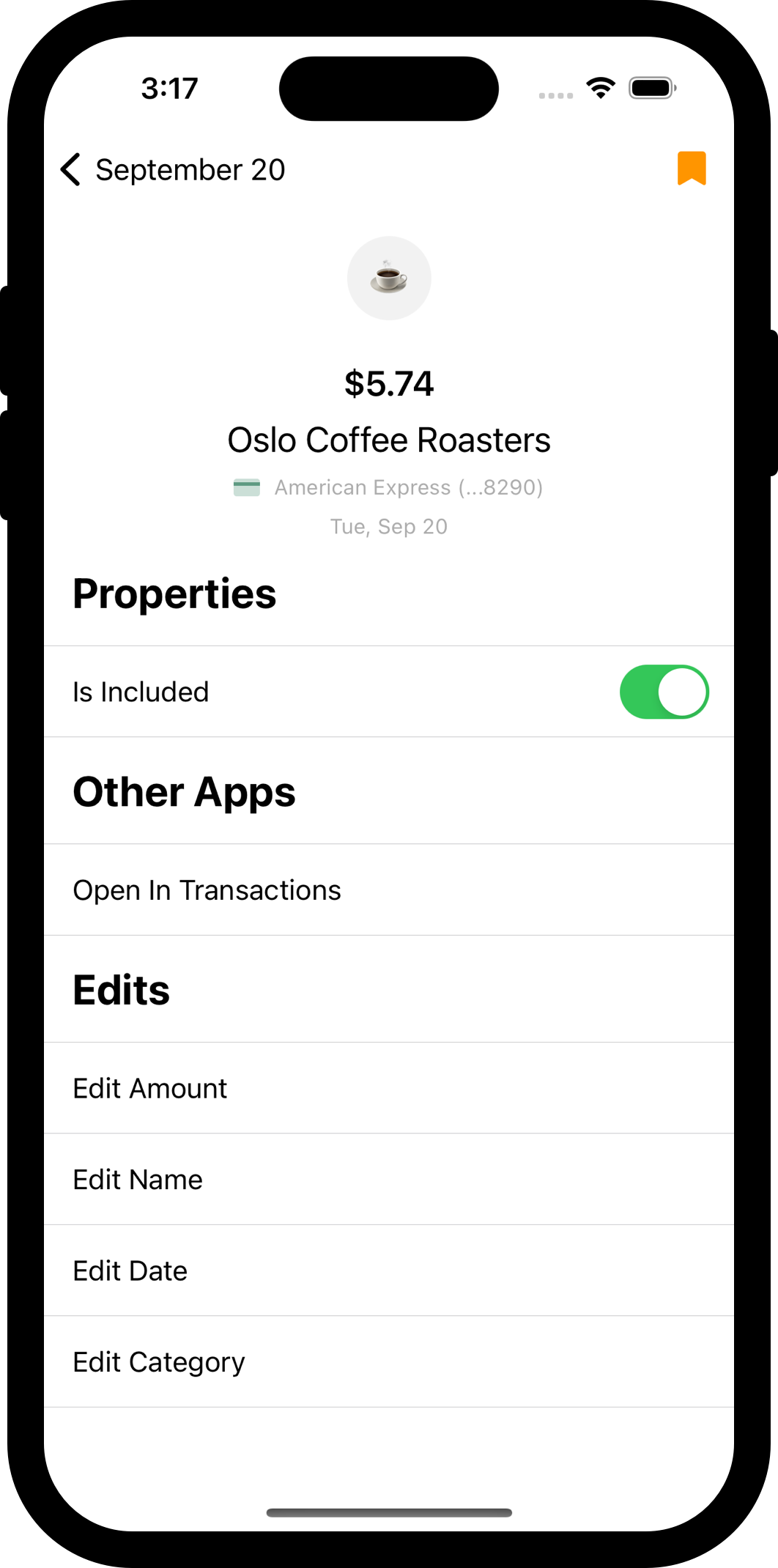

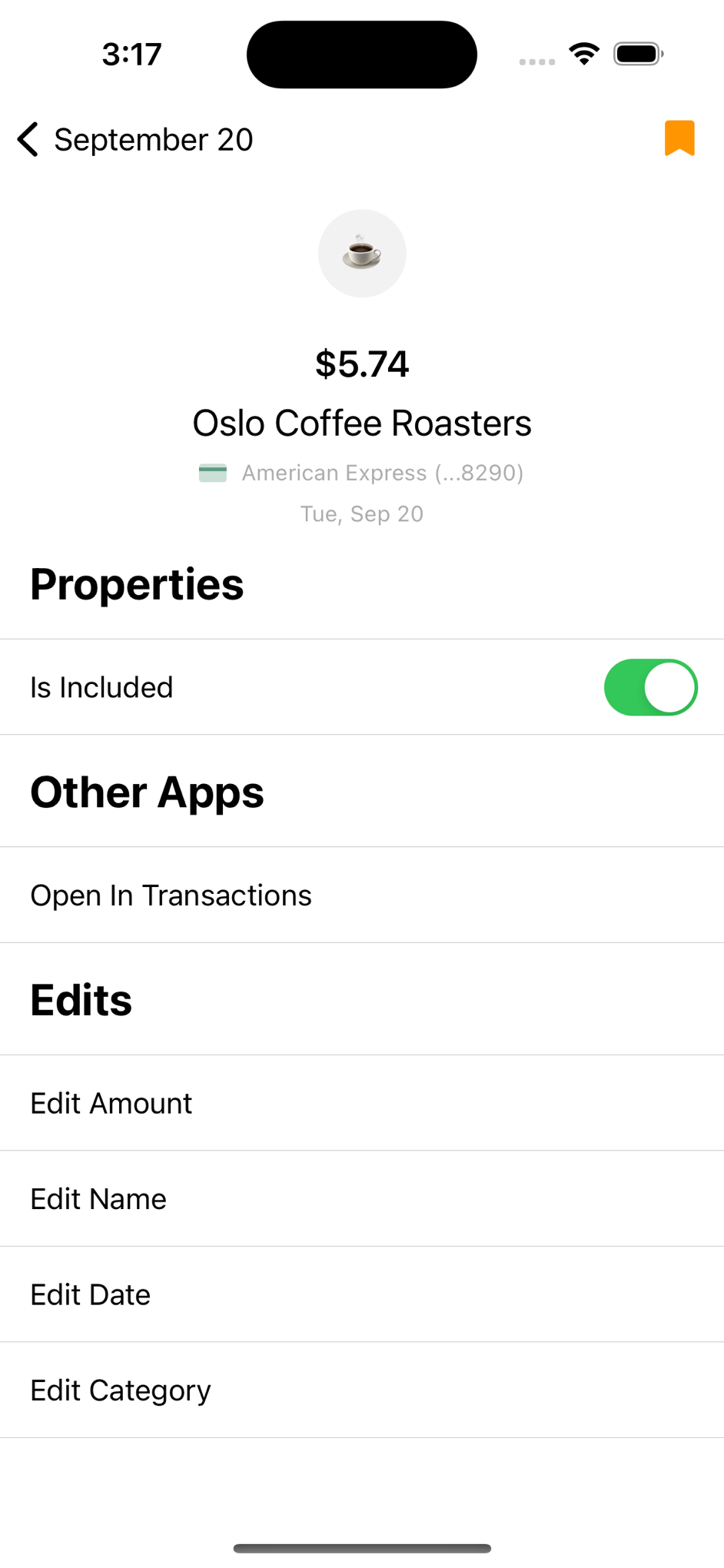

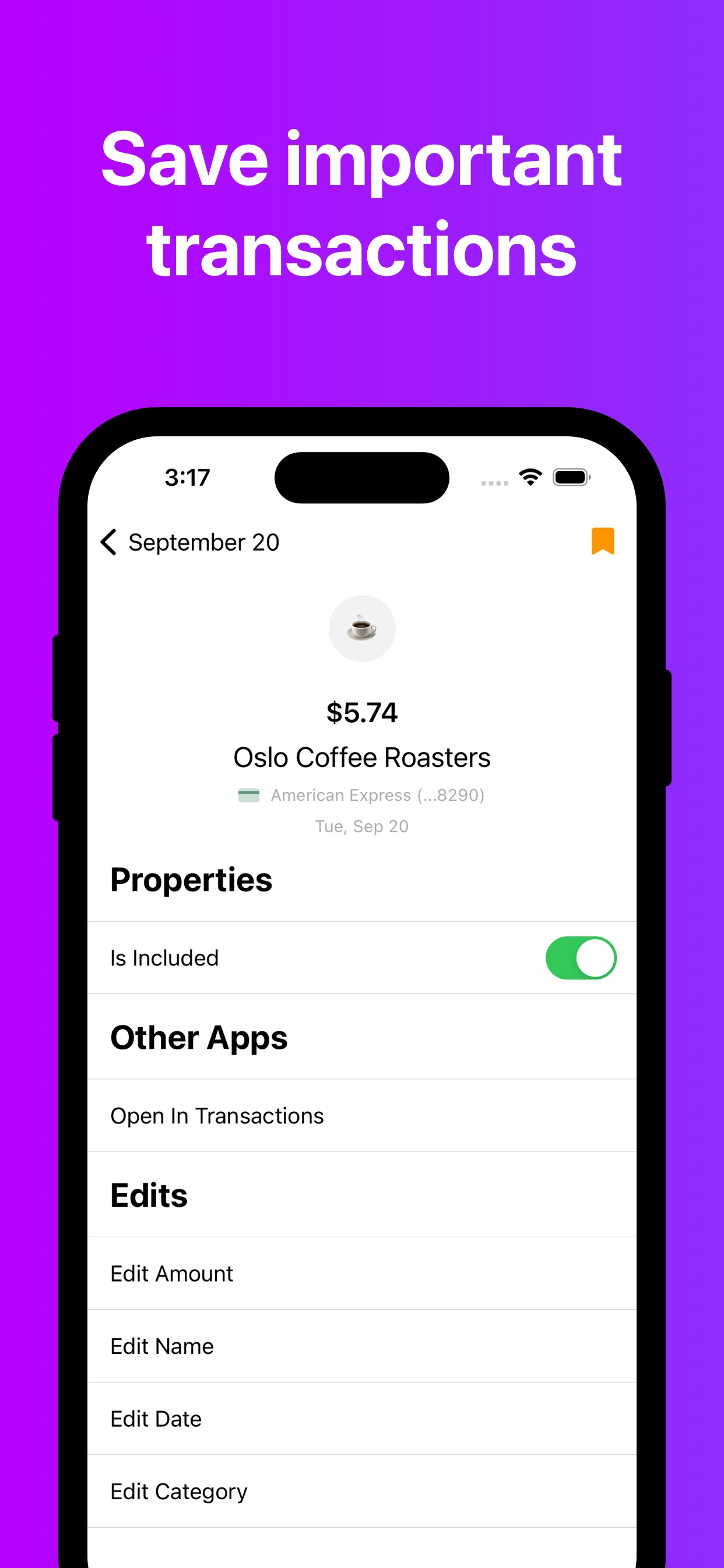

Save Transactions

Quickly save transactions when you want to remember to split a bill or expense a purchase later.

-

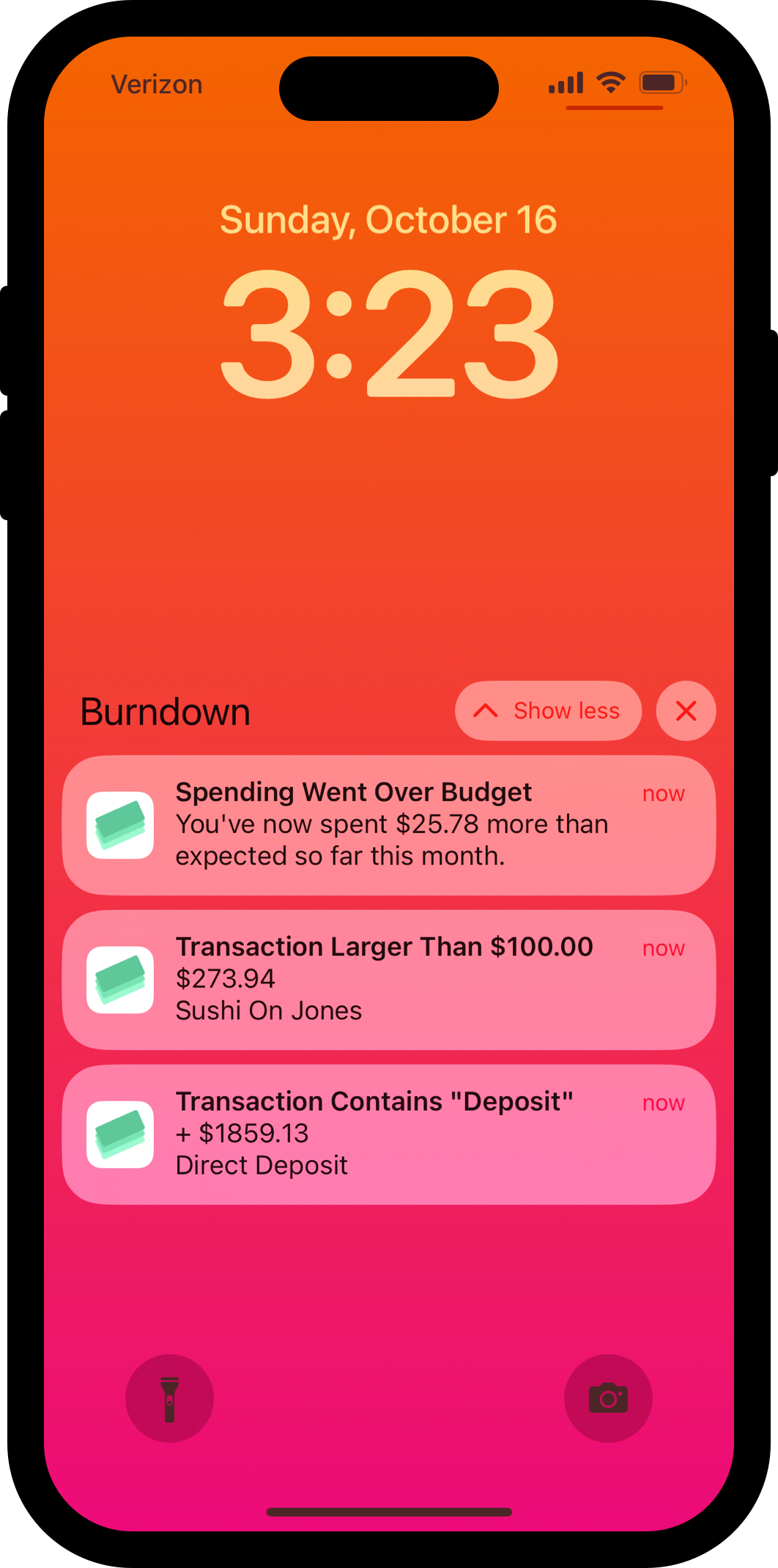

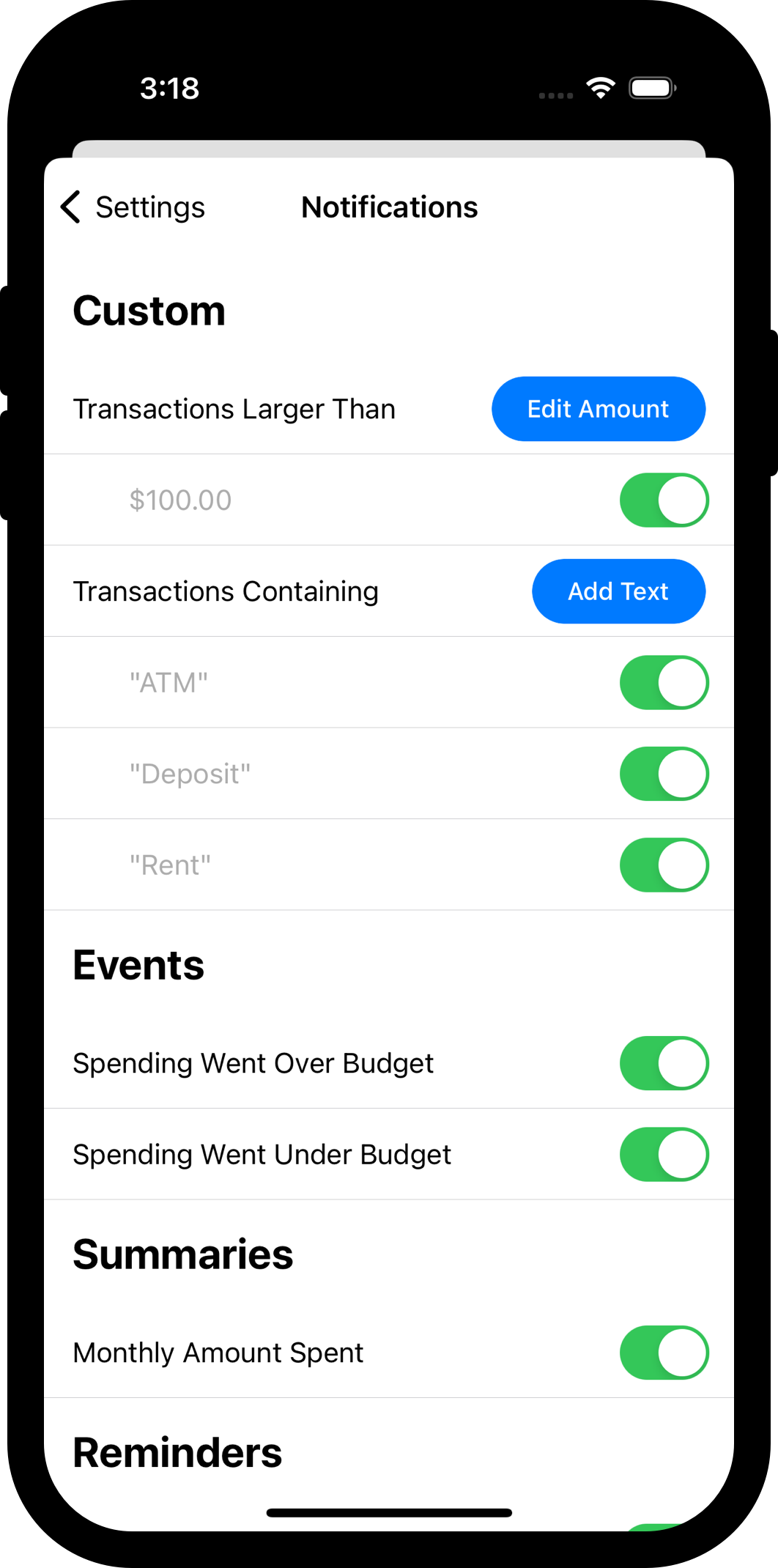

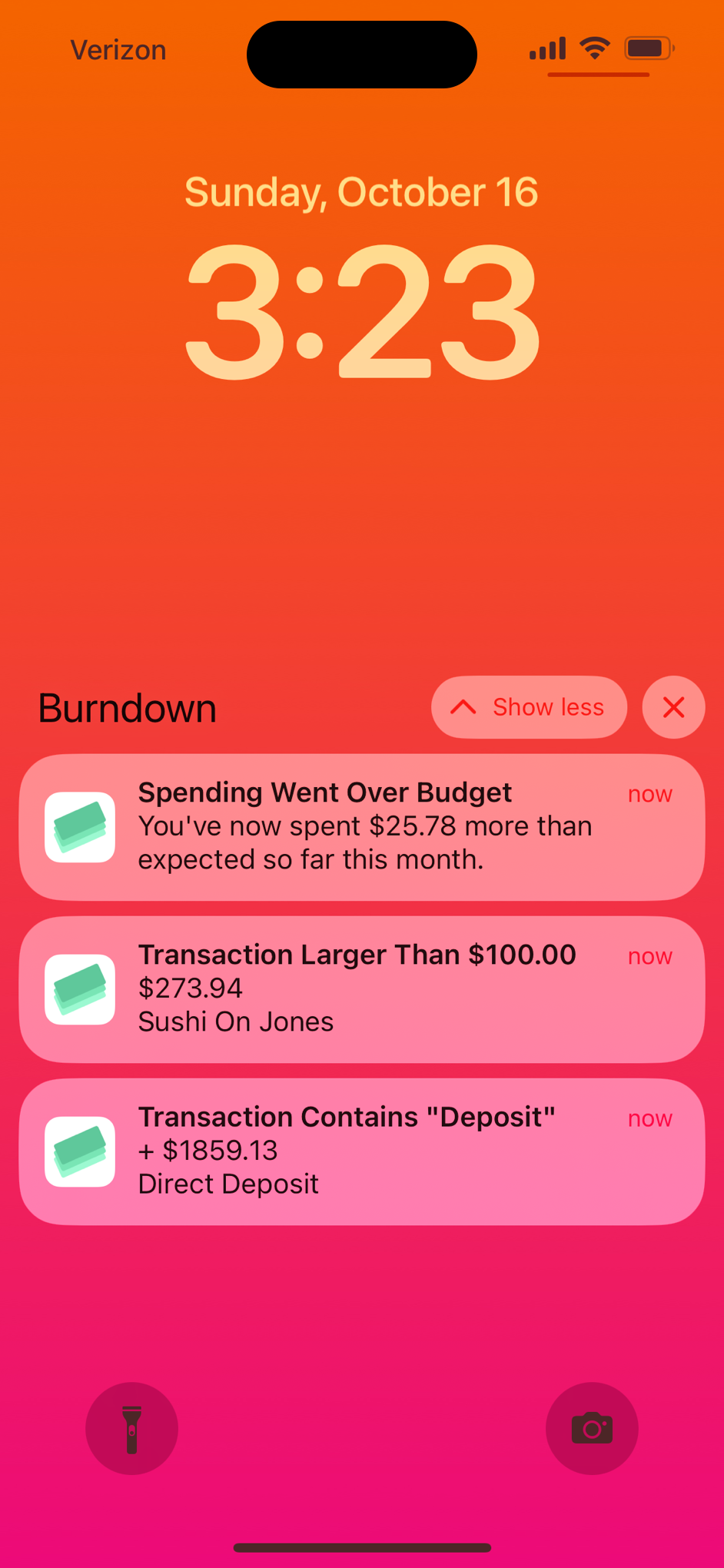

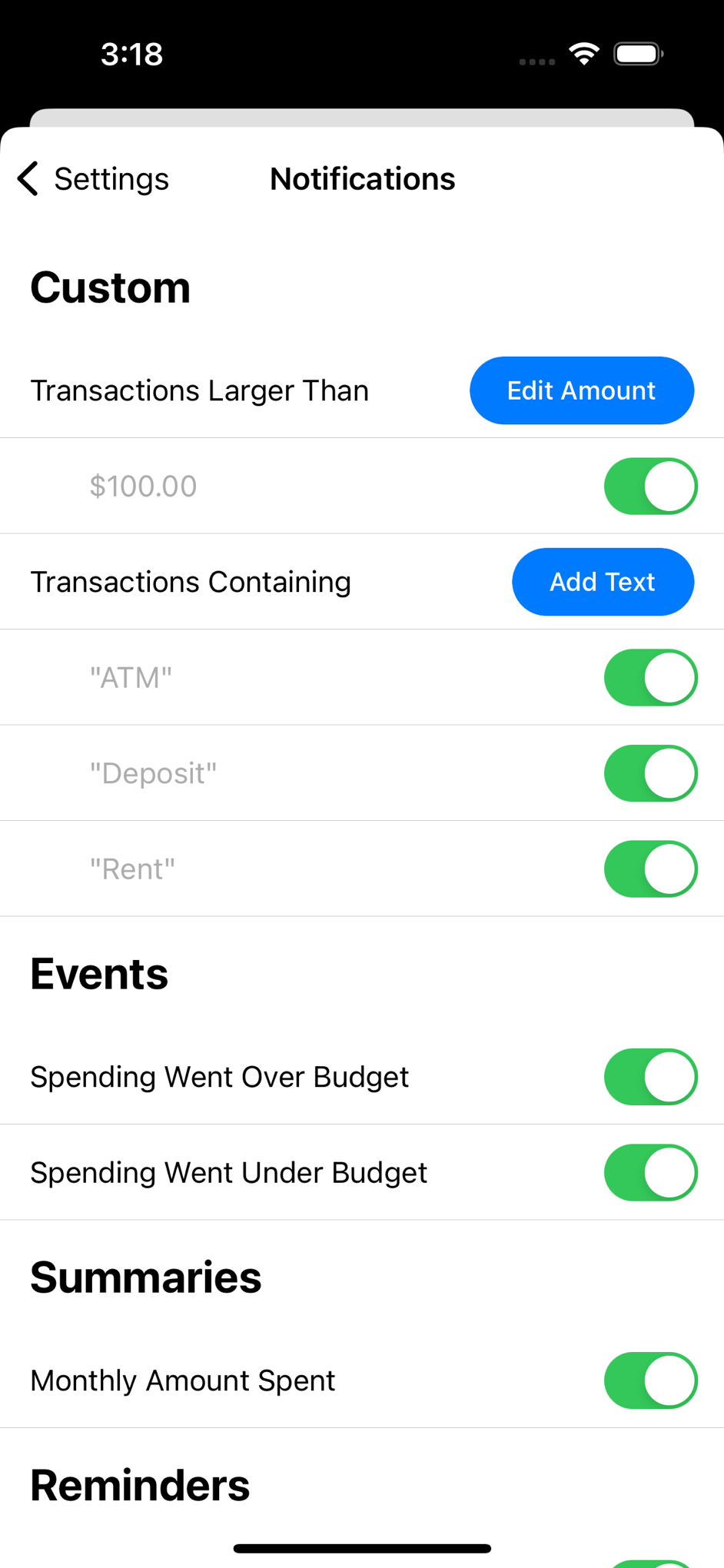

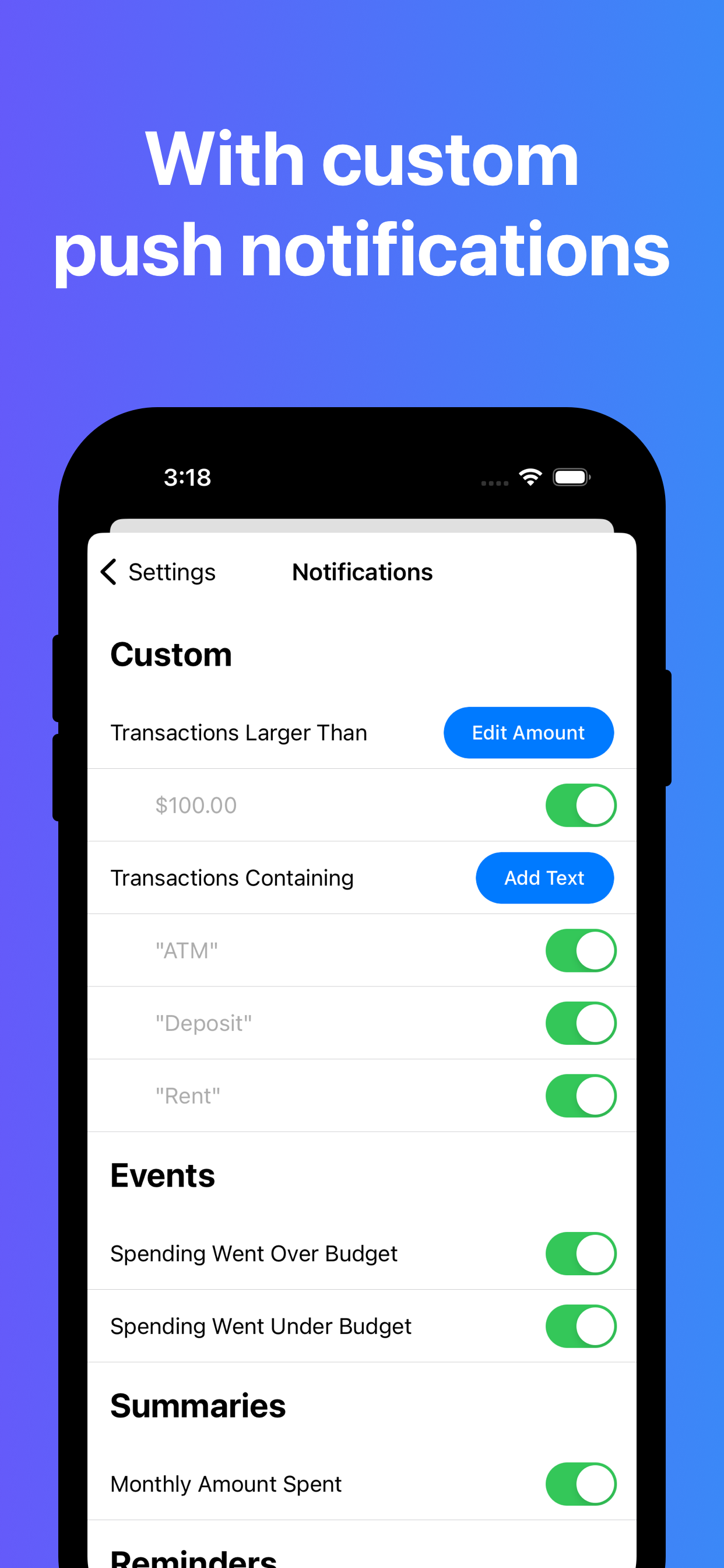

Custom Notifications

Create custom push notification triggers. Set alerts for when a transaction is above a certain amount or contains specified text.

-

Secure And Private

Your information is completely safe. You'll use Plaid to link your cards. Your credentials are end-to-end encrypted and completely inaccessible to the app.

In-App Purchases

Finance Kit Pro

1 week free trial, then $2.99 per month or $29.99 per year.

Every user is allowed to link one card for free, which is enough for many people. Pro users can link multiple. This goes toward maintaining encrypted and private connections with the banks.

Subscribing to Pro enables linking multiple cards across all of the Finance Kit apps, including Transactions.

Developer

Gavin King

Platform

iOS 15+

Media

Download everything or save individual media below by either dragging and dropping or right-clicking and saving.

Icons

Small (64x64)

Medium (256x256)

Large (1024x1024)

Screenshots

Groups

Individuals